If you’re in Ireland and looking at How to Invest in the S&P 500 from Ireland, you might have found yourself a bit lost. It’s not as straightforward as it seems right? Maybe you’ve been wondering Which ETF you should choose, Which platforms can trust here in Ireland, and How to avoid those pesky currency conversion fees. These are common hurdles for Irish investors.

They can make the process feel overwhelming but don’t worry, I’m here to help you cut through the confusion. In this article, I’m going to walk you through exactly how to invest in the S&P 500 from Ireland. I’ll show you how to pick the right ETFs, avoid unnecessary fees, and choose a platform that works best for you.

How to invest in the S&P 500 from Ireland

1. Pick an ETF tracking the S&P 500 in Ireland

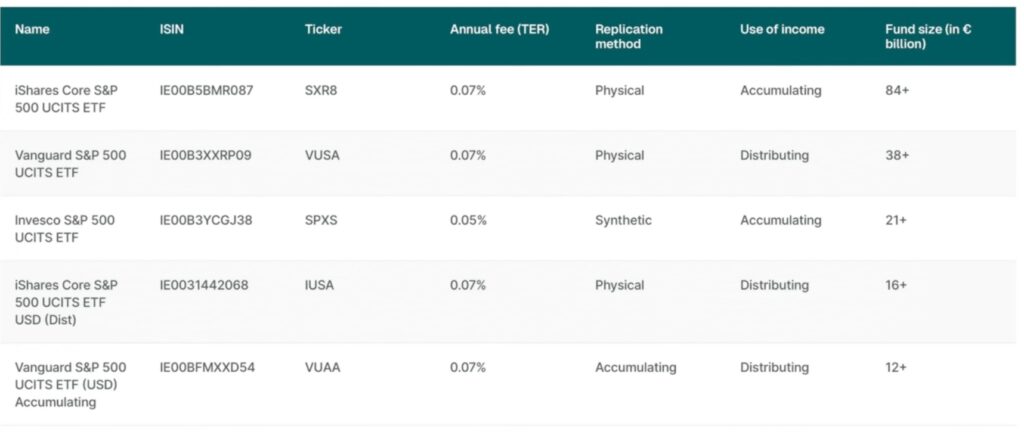

The S&P 500 consists of the leading 500 publicly traded us companies. it includes large well-known companies such as Apple Tesla and Microsoft to name a few while you can’t directly buy the S&P 500 Index you can invest in an exchange-traded fund ETF that replicates the index’s performance for Irish investors it’s important to note that you can’t invest in US ETFs instead there are Europe specific ETFs that comply with European regulations on the screen you’ll see the 5 largest S&P 500 ETFs available for Irish investors

this list was curated using just ETF a handy tool for finding and comparing ETFs we would recommend one of the first to iShares or Vanguard for these reasons.

- Both present a total expense ratio TER of 0.07% which is considered very low.

- The replication method is physical meaning that you are investing in the underlying assets.

- These two are the biggest ETFs by Asset Under Management (AUM), so they are extremely unlikely to be closed down.

2. Choose a Good ETF Investment Platform

Having selected one of the ETFs, you need to find a broker where you can invest in it. we’d feel confident investing with any of the platforms listed for more advanced investors with larger portfolios we recommend Interactive Brokers one of the top investment platforms globally for beginners Trading 212 is an excellent choice.

Additionally, We have featured step-by-step guides on How to invest in the S&P 500 using various platforms including ibkr and trading 212 so be sure to check out our other Articles.

3. Place your order

Once you find an online platform that meets your needs it’s time to place a buy order for your chosen ETF. For this example, we’ll use interactive brokers.

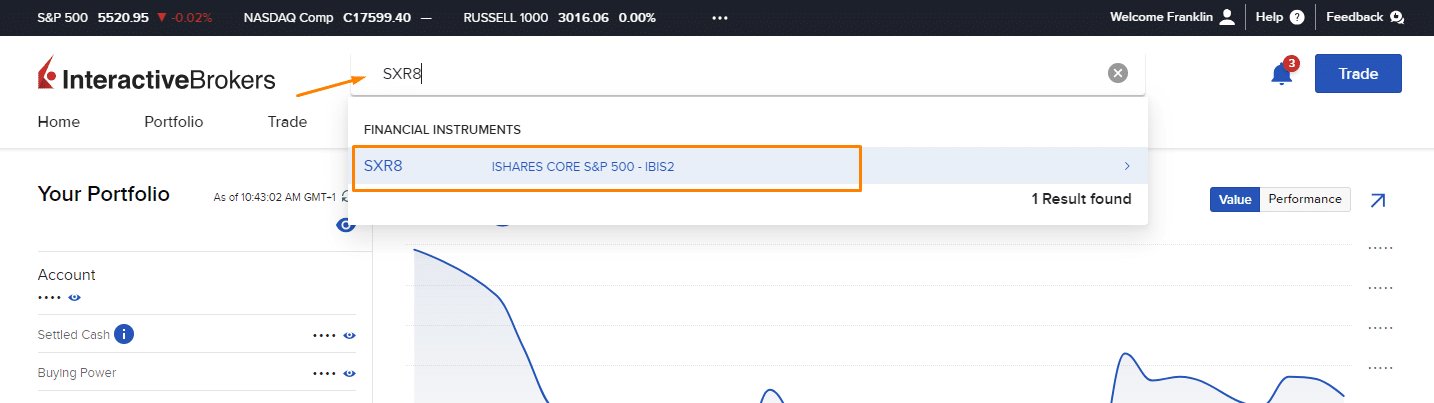

Search: we’ll use SX R8 in this case Since this is the largest S&P 500 ETF by assets furthermore it is quoted in Euros.

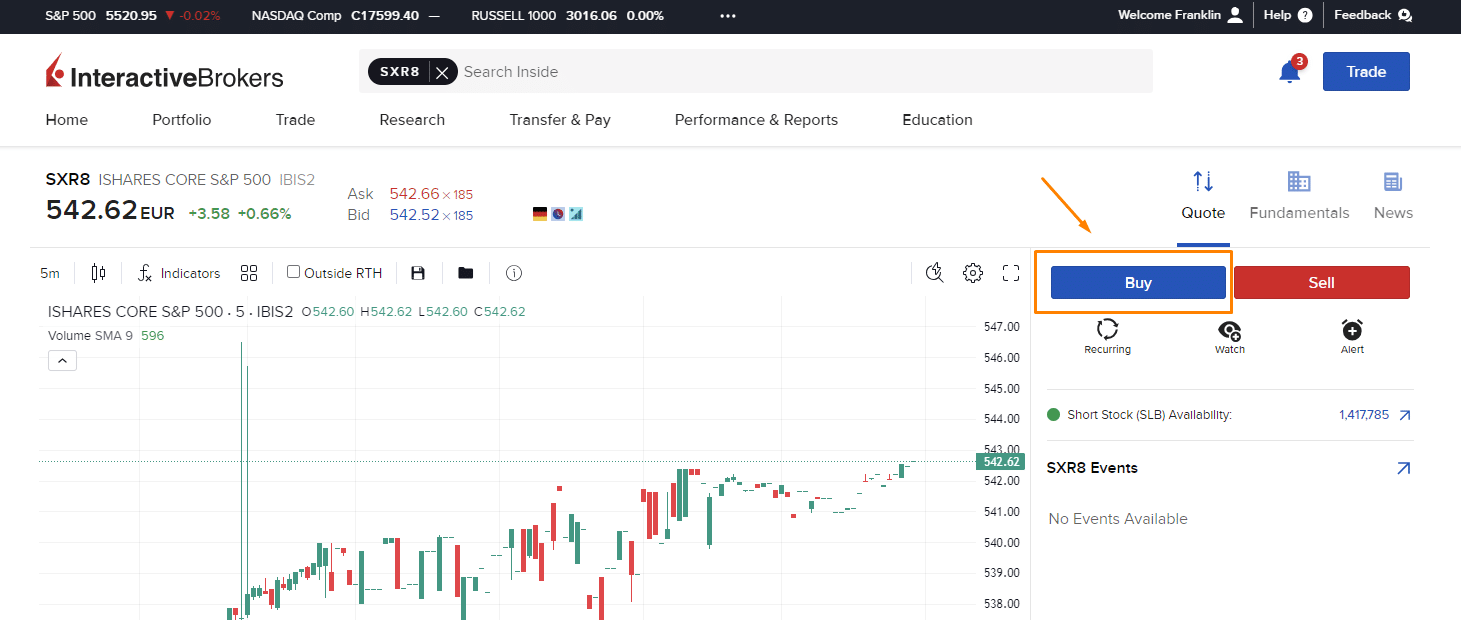

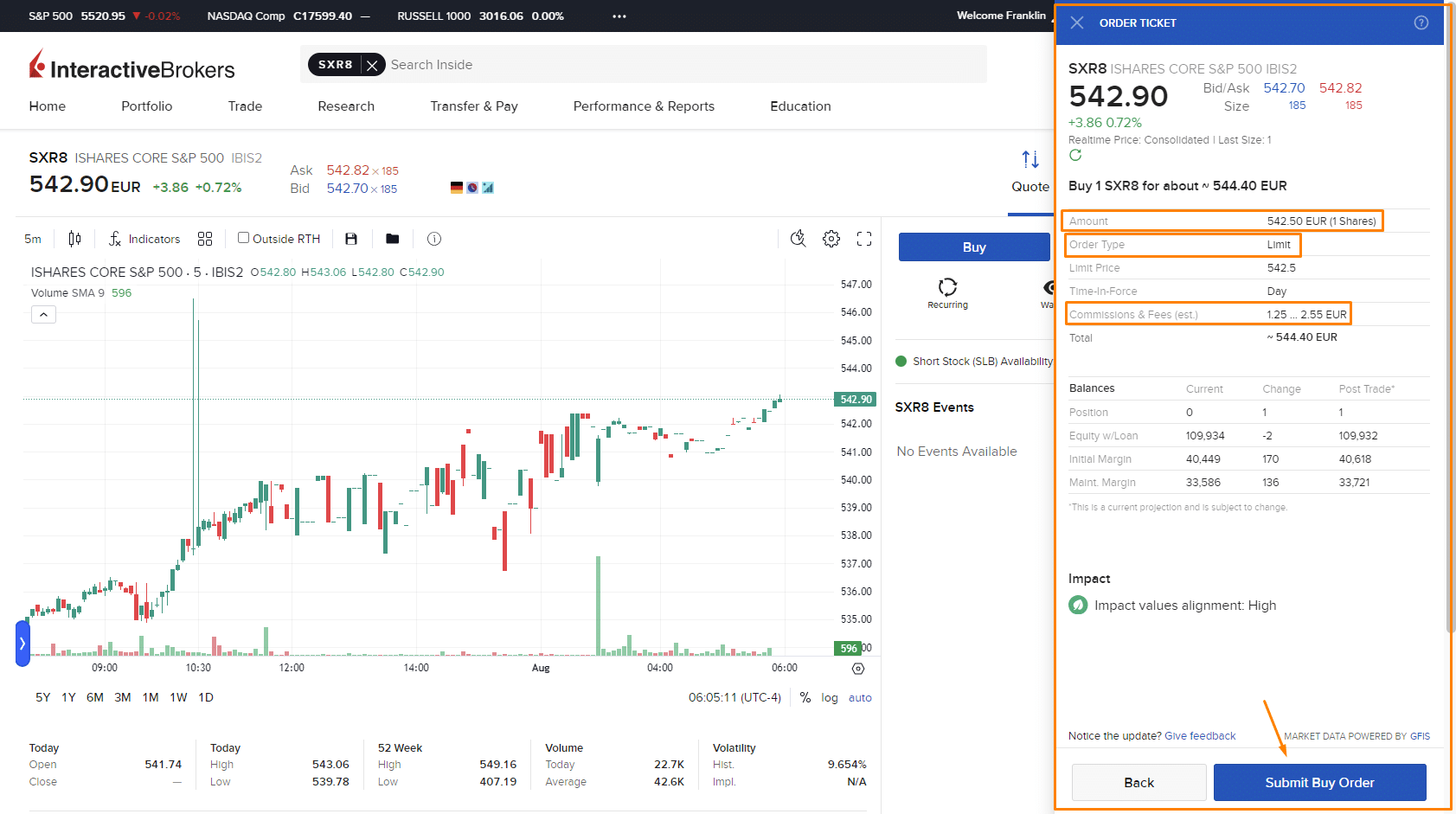

Click buy and enter the order details Then you need to choose the number of shares you want to buy and the order type we will now buy two shares using a market order.

Click Submit buy order and you’re ready to go That’s it our order has been filled as you can see it’s pretty straightforward.

We hope you found this article helpful if you have any comments or feedback please leave them below.

Also Read

a1tu9a