Trading 212 vs Interactive Brokers: In today’s article, we’ll be comparing two popular Brokers Interactive Brokers and Trading 212, both are great options but depending on your needs one may be a better fit for you if you’re just starting out, Trading 212 might be appealing, especially with its user-friendly app and the ability to earn a free share when you sign up with our code. I ITW on the other hand if you’re a more experienced investor interactive broker.

Overview of Trading 212 and Interactive Brokers

Trading 212

Trading 212 founded in 2004 is based in the UK and has grown to be a popular choice for European investors especially beginners, The platform is commission-free for stocks and ETFs and they’re about to launch a debit card in Europe. additionally, they offer High interest on deposits 4% in Euro 5.1% in GBP, and 5.1% in USD at the time of making this video among other currencies, on the other hand,

Interactive Brokers

Interactive brokers IBKR has been around since 1978 and is a global Powerhouse with a presence across five continents it’s listed on the NASDAQ Stock Exchange and is known for being a serious broker for investors wanting more advanced tools and access to a wide range of assets they’re also well regarded for their security and long-standing reputation

Range of Investment Option

Both interactive brokers and Trading 212 offers a wide range of investment options you can trade stocks ETFs and CFDs on both, however,

Interactive brokers pull ahead with options like options pun intended Futures and bonds if you’re looking for something simple

Trading 212 is a solid option but if you’re someone who wants to explore a variety of assets and take your investing to the next level Interactive Brokers is the place to be.

Interest in cash balances

let’s move on to one of the most talked about features interest on uninvested cash

Trading 212 offers High interest on your cash balance in several currencies with no minimum deposit making it a great way to earn while you decide where to invest

Interactive Brokers offer interest too but the rates are tiered for euros you start earning interest once you have more than € 10,000 cash in your account and you only earn the full rate if your overall portfolio value is over €100,000

so for smaller trading 212 wins here

Trading Platforms: Trading 212 vs Interactive Brokers (IBKR)

now let’s dive into the trading platforms

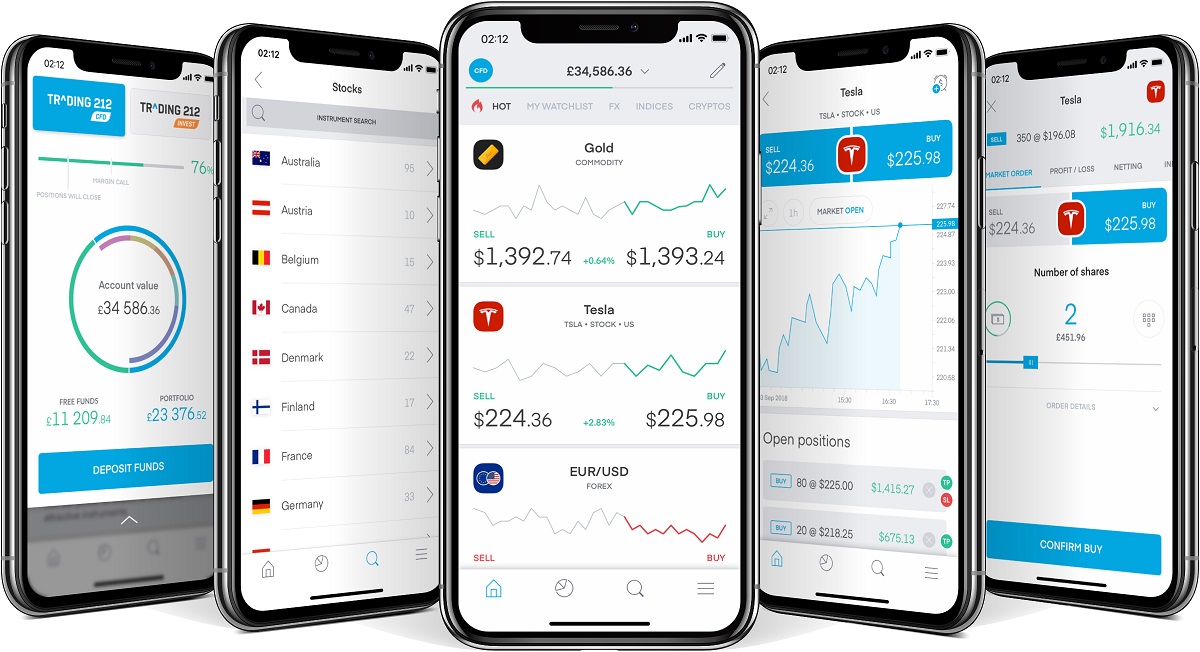

Trading 212: Trading 212 is well known for its user-friendly app it’s clean easy to navigate and perfect for beginners their pies feature even allows you to automate your investments into multiple assets which is great for long-term investors

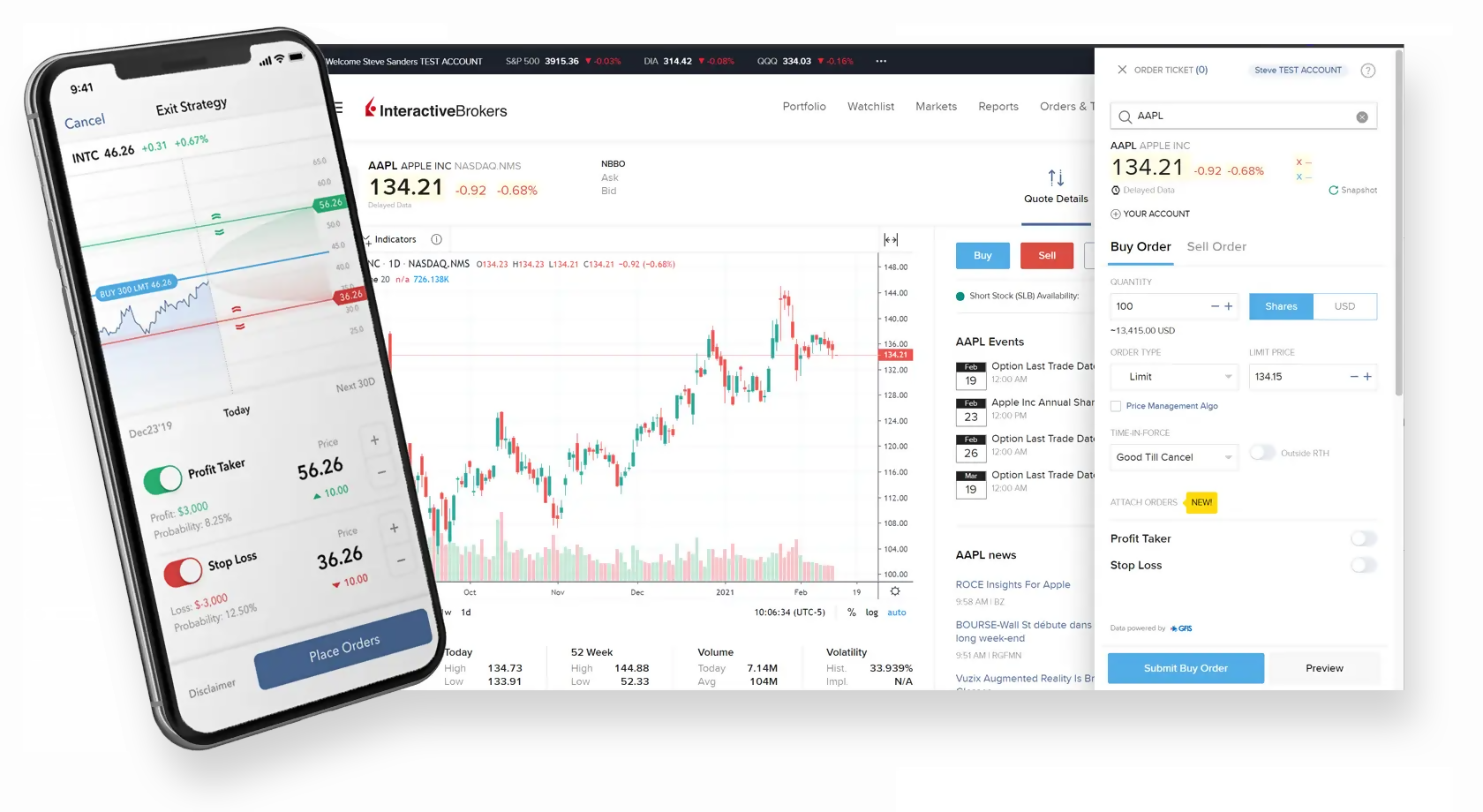

Interactive Brokers: Interactive Brokers, on the other hand, offer multiple platforms including their Flagship Trader workstation TWS is loaded with Advanced features with over 50 order types and professional-grade tools, well TWS may seem intimidating at first IBKR also offers simpler options like their mobile app which has significantly improved and is now easier to use for tech-savvy users or those looking for powerful tools IBKR is the way to go but for Simplicity and ease of.

Fees

now let’s talk about costs

Trading 212 stands out with its commission-free trading on stocks and ETFs they also don’t charge fees for inactivity or deposits however it’s important to note that they make money through spreads the difference between the buy and sell price of assets and also with currency conversion fees by charging 0.15% each time you buy an asset traded in a currency different from your account currency for smaller Investments these aren’t as noticeable but for larger amounts they can represent a significant cost interactive brokers, on the other hand, has a more complex pricing structure with two models fixed and appeared.

Interactive Brokers charge a small fixed commission per trade but their spreads tend to be tighter this means that while you’re paying a fee upfront the implicit cost of the spread is much lower interactive brokers charge a small fee to deliver their quality service but make no mistake trading 212 is also a good option, especially for smaller accounts where the spread costs aren’t as impactful lastly.

Customer Service

let’s take a look at customer service

Trading 212 offers support in multiple languages and has a responsive customer service team, especially for beginners

Interactive Brokers Provide support via phone email and chat but are known for slower response times and a more complex experience quick and efficient support is a priority

Trading 212 may have the edge here so which one is right for you if you’re a beginner looking for a simple user-friendly app Trading 212 is a fantastic choice, especially with perks like 4% interest on your invested euros and commission-free stock and ETF trading plus don’t forget to use our code IW for a free share however

Conclusion

if you’re a more serious investor or looking for a platform with more advanced tools Interactive Brokers is the clear winner here their robust platform security and access to global markets make them ideal for long-term and high-volume traders in our opinion both are great options depending on your needs that’s it for today’s comparison.

Also Read